- Email info@unifycu.org

- Head Office 01942 245656

- Repay Your Loan

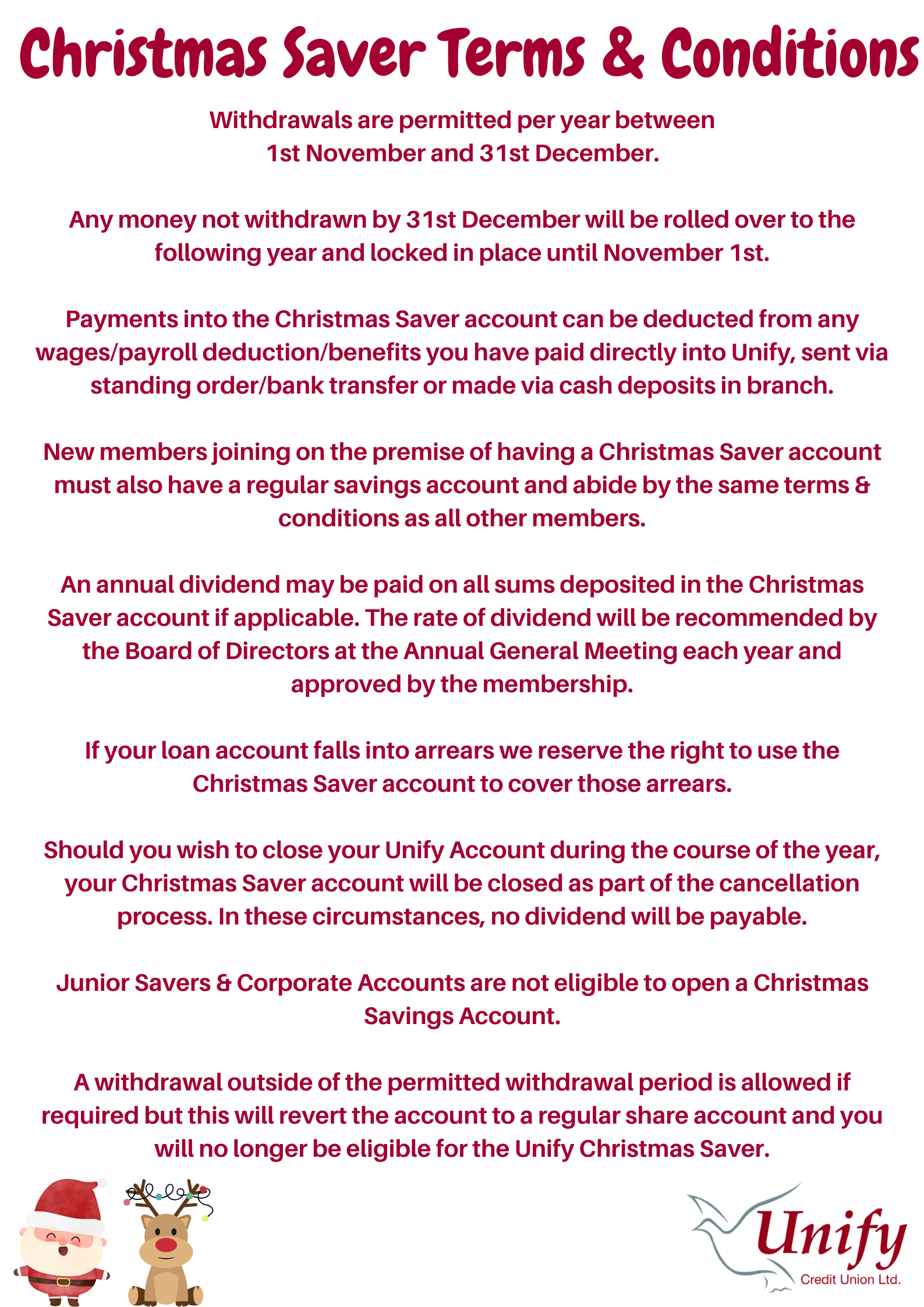

Save Smart for a Merry Christmas with Our Christmas Saver Account!

Get ready for a stress-free Christmas in 2026! After amazing feedback last year, our Christmas Saver Account is back to help you spread the cost of the holidays and start planning early.

Getting Started is Easy! You must be 16 or over

If You’re a Member: Email your local branch to set up your Christmas Saver Account.

🎁 Don’t wait—start today! The sooner you save, the more you’ll have for a magical holiday season.

Quick Links to Begin

Why Choose the Christmas Saver Account?

If you want to save for a rainy day or a holiday, a Unify account is quick and easy.

If you need a loan with Unify Credit Union, click here to find out more.

Find out more about how to easily pay into your account with us