Unify's Loans

____________________________________________________________________________

See how much you could save by choosing us instead of credit cards, payday loans, or doorstep lenders.

At Unify Credit Union, we’re here to help, whether you’re a new member or have been with us for years. Our loans are designed to fit your needs and give you more control over your finances.

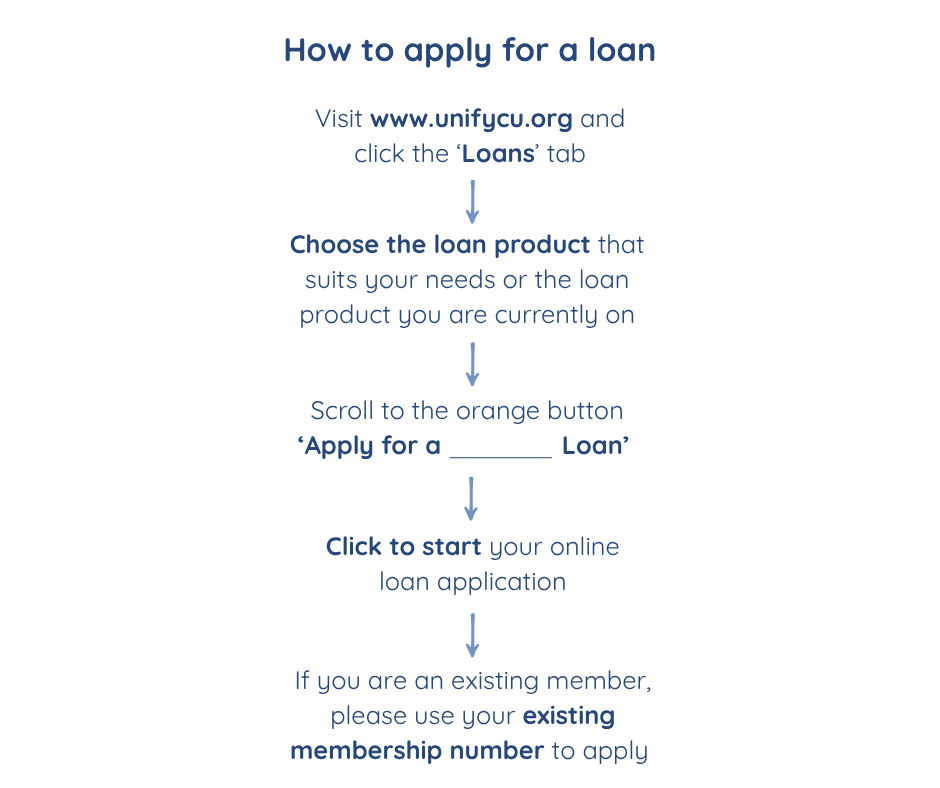

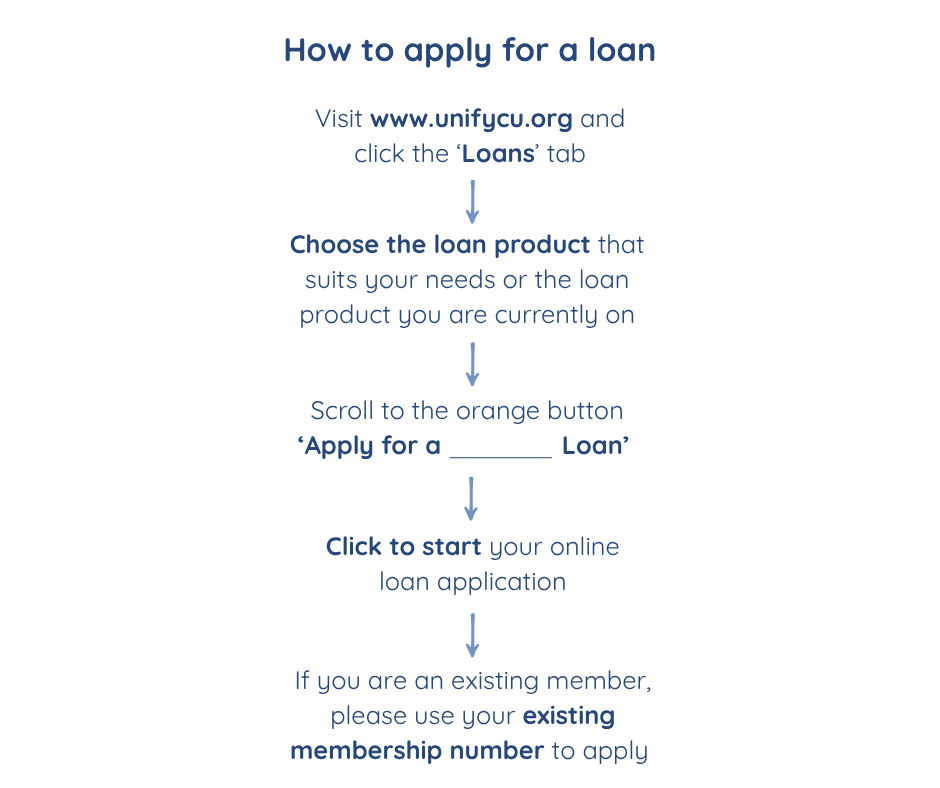

We offer a variety of loan options for everyone, from first-time borrowers to long-time members. Scroll down for our Loans at a Glance Key Information, links to our loan product pages to learn more and apply.

You must live or work within our common bond to be eligible to apply for one of our loan products.

- Eligibility:

- Existing Members

- New Members - no savings history with credit union required

- Must be in receipt of a non-means tested benefit: Child Benefit, State Pension, Carers Allowance, Personal Independence Payment (PIP)

- Amount: Maximum loan amount £1,500 above savings.

- Top ups: Available after 6 months – Maximum amount £1000

- Repayments: Maximum Term 18 Months

- Interest: 3.0% (42.6% per month)

- Credit Check: Required for all applications

- Borrowing requirements:

- Must save at least £2.50 per week (£10/month)

- Must have benefit paid directly to Credit Union. Helps build your credit history.

- Must provide 1 months’ bank statement for all household accounts

- New members -Pass electronic ID & Verification / provide proof of ID

- New members - Pass electronic address verification / provide proof of address

- Remain on product for minimum 2 years

- Extras: Loan Protection Insurance included

- Loan Policy General Conditions apply

For more information please see the Starter Loan page

Apply for a Starter Loan

- Eligibility:

- Borrowing: Maximum £3,000 above Share 1 Savings

- Top ups: not specified

- Repayments: Maximum 36 months – Must pay by Standing Order or Payroll Deduction if Trusted Partner Employee

- Interest: 1.0% per month (12.7% APR)

- Credit Check: Required for all applications

- Borrowing requirements:

- Save at least £20.00 per month

- Been in employment for 6 months

- Very Good / Excellent Credit Score

- 1 Months Bank Statements for all household accounts

- 3 Months Payslips

- Extras: Loan Protection Insurance included

- Loan Policy General Conditions apply

For more information please see the Premier Loan page

Apply for a Premier Loan

- Eligibility:

- EXISTING Members employed by Trusted Partners

- Borrowing: Maximum £2,000 above Share 1 Savings

- Top ups: Available after 6 months of repayments

- Repayments: Maximum 36 months

- Interest: 2.5% per month (34.5% APR)

- Credit Check: Required

- Borrowing requirements:

- Save at least £20.00 per month

- Employed by Trusted Partner

- Provide 1 Months Bank Statements for all household accounts

- Provide 3 Months Payslips

- Extras: Loan Protection Insurance included

- Loan Policy General Conditions apply

For more information please see the Workplace Loan page.

Apply for a Workplace Loan

- Eligibility:

- Existing Members

- NEW Members - no savings history with credit union required

- Must be in receipt of Child Benefit in your name

- Child Benefit must be paid directly into your Unify account

- Borrowing: Up to £750 above your savings

- Top ups: Available after 4 months – or at discretion of lending team

- Repayments: Maximum 75 weeks Weekly, fortnightly, or monthly –

- Interest: 3.0% per month (42.6% APR)

- Credit Check: Not required unless evidence of adverse credit or debt collection activity.

- Borrowing requirements:

- Must save at least £2.50 per week (£10/ month)

- Must provide 1 month’s bank statement

- New members - Pass electronic ID & Verification / provide proof of ID

- New members - Pass electronic address verification / provide proof of address

- Extras: Loan Protection Insurance included

- Loan Policy General Conditions apply

For more information please see the Family Loan page

Apply for a Family Loan

- Eligibility:

- EXISTING Members

- Must have saved regularly or established savings during 2 years on Starter Loan

- Borrowing:

- Top ups: Available after 3 months – may be extended at discretion of lending team

- Repayments: No minimum term – Maximum Term 36 months – may be extended to 60 months at discretion of lending team

- Interest: 2.5% per month (34.5% APR)

- Credit Check: Required for all applications

- Borrowing requirements:

- Save at least £2.50 per week (£10/ month)

- Maximum £7500 above savings

- Maximum £1000 above savings in first year of membership

- Provide 1 Month’s Bank Statement for all household accounts

- 3 months Bank Statements if amount > £3000

- Saved (without withdrawal) for at least 10 out of the last 13 weeks, 6 consecutive fortnights or 3 consecutive months

- Extras: Loan Protection Insurance included

- Loan Policy General Conditions apply

For more information please see the Saver Loan page.

Apply for a Saver Loan

- Eligibility:

- EXISTING Members

- Minimum 2 Yrs on Saver Loan

- Borrowing: Maximum 4x Share 1 Savings or £7500 whichever is lower

- Top ups: After 3 months – Extended at discretion of lending team

- Repayments: Maximum Term 36 months –Exceptional circumstances 60 months at discretion of lending team

- Interest: 1.5% per month (19.6% APR) up to £2999 - 1.0% per month (12.7% APR) £3000+

- Credit Check: Required for all applications

- Borrowing requirements:

- Save at least £2.50 per week £10.00 per month

- 1 Months Bank Statements for all household accounts

- 3 Months Bank Statements if >£3000 above savings

- Extras: Loan Protection Insurance included

- Loan Policy General Conditions apply

For more information please see the Loyalty Loan page.

Apply for a Loyalty Loan

- Eligibility:

- Borrowing: Minimum £100 (each application) Maximum equivalent to value of Share 1 Savings

- Top ups:

- Repayments: Maximum Term 60 months

- Interest: 0.48% per month (6.0% APR)

- Credit Check: Not Required

- Borrowing requirements:

- Save at least £1.00 per week

- Extras: Loan Protection Insurance included

- Loan Policy General Conditions apply

For more information please see the Secure Loan page

Apply for a Secure Loan

Loan Policy General Conditions apply to all loans.

IMPORTANT - if you are in a debt management plan, subject of a Debt Relief Order, IVA or bankruptcy or not currently up to date with household bills we are unlikely to be able to provide you with a loan.

Debt advice can be obtained, free of charge, from STEPCHANGE, DEBT ADVICE FOUNDATION or your local CITIZENS ADVICE.

Free and impartial money advice can be obtained from The Money Advice Service.